Content

- Disallowing Premium Taxation Loans for certain Visibility Signed up for During the Unique Registration Symptoms

- Season transform. Advantages twice. Guide. Stand. Earn 2X the newest things.

- How come The balance Affect Individual Earnings Taxpayers?

- Secure Marriott Things to the Emirates Aircraft & Earn Emirates Skywards Miles to the Marriott Stays

Productive to possess taxable many years delivery immediately after December 29, 2025, the brand new OBBB takes away the new limitation to the level of income tax imposed for an excessive amount of income tax credits within the ACA (such as, in the eventuality of increased home earnings). An entire deduction number was offered to people with upwards so you can $75,100000 in the changed adjusted gross income, and you will $150,100000 when the married and you can submitting as one. To the a bump, the brand new creature requires 1d8, your Charm modifier acid wreck. It wreck increases by 1d8 from the sixth (2d8), 9th (3d8), 12th (4d8), fifteenth (5d8), and you will eighteenth (6d8) top. If a creature is actually reduced to help you 0 hit things from this element, it is instantaneously slain, exploding for the bits and pieces. The newest deduction manage implement just to private filers 65 and you may older which have a modified modified gross income all the way to $75,000, or maried people as much as $150,100.

If you keep assets for starters seasons otherwise quicker, one money obtain during the sale otherwise disposal is known as small-identity and usually taxed at your ordinary income tax speed. For those who keep possessions for more than 12 months prior to disposing of those, their investment obtain is regarded as a lot of time-identity which is taxed from the rates all the way to 20%. While the trader keeps their interest in the new money for 5 many years, the new buyer gets a good 10% base boost, which will make sure merely 90% of your deferred gain try taxed should your funding are stored for around 5 years. To have investment inside the recently created qualified rural chance financing, 30% of the deferred get is put in basis. Eventually, the new OBBB recommends a keen inflation-adjusted minimum deduction out of $400 to own taxpayers who’ve at the least $1,100000 from QBI from one or maybe more effective trading or companies in which they materially engage. The usa Congress has shed its choose in favor of “Usually the one Larger, Breathtaking Costs” (OBBB), a great capturing taxation reform step made to redesign the new U.S. taxation code.

Disallowing Premium Taxation Loans for certain Visibility Signed up for During the Unique Registration Symptoms

A normal schedule is to have the option or guarantee gives vest over three to five many years. So it acts as a retention tool, and it encourages staff to maintain an extended-identity focus to ensure the organization well worth — thin alternatives or equity well worth features ascending. You will get wood from your system, enabling you to shed Entangle since the a bonus step several of that time comparable to your own Charm modifier. Since the a task, you might capture plenty of lasers from the fingertips equal to the competence incentive.

Season transform. Advantages twice. Guide. Stand. Earn 2X the newest things.

The increased exception may necessitate a great reevaluation from existing faith formations as well as the institution of new of these. From the information and leveraging the changes adopted because of the OBBB, someone can be improve the property plans to remove https://happy-gambler.com/mega-fortune-dreams/rtp/ income tax obligations, maximize riches transfer, and you will get to its enough time-identity monetary requirements. The little one income tax borrowing from the bank lets family members a taxation crack out of up to help you $2,100 per being qualified kid. The child taxation credit are income-dependent and susceptible to phase-aside.

It could be offered to the elderly whether or not they make the simple deduction otherwise itemize their production. The new TCJA twofold the high quality deduction number from the earlier accounts, but that has been short term. For 2025, the product quality deduction try $15,100 for those and you may married people filing independently, $30,100000 for married people filing together, and $22,five-hundred for brains of house. The fresh rules expands and you will develops conditions of your own 2017 measure you to benefit somebody taking care of suffering members of the family, through income tax credit to own employers that offer repaid family members and you may medical log off. When you arrive at 6th level, the relevant skills and you may quirks you’ve collected will be died to a creature you could potentially contact while the an action.

How come The balance Affect Individual Earnings Taxpayers?

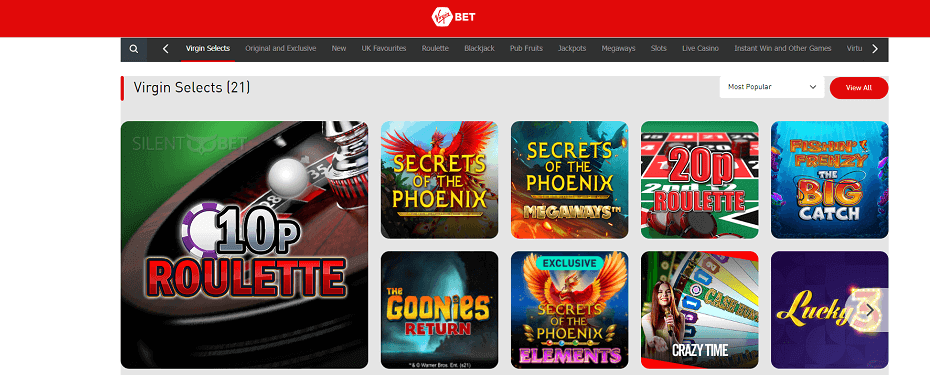

For every earn for the reels offers an opportunity to home you to best big victory, whoever amount you should check for the display screen at the top of the video game display screen. The most used icons is the fruit container, jug, trumpet and you will pistols. Line up step 3 or maybe more similar icons to your an activated payline, and you may win as much as 125 moments the value of your own bet with the icons – which is currently a great winnings. The newest epic Musketeers are straight back, this time inside the a legendary and you can satisfying slot machine games one now offers players many freedom playing but they require. One other way you to incentives might be prepared is about as to the reasons he could be paid out. So it incentive is founded on your individual performs whether it’s associated with the new results remark process, otherwise your settlement structure you’ll show specifically the outcomes you need qualify for an advantage payment.

The initial arranged flights to help you Chișinău become on the 24 Summer 1926, on the route Bucharest–Galați–Chișinău and you may Iași. The brand new routes were work by the CFRNA, later LARES.6 A commemorative plaque, describing the first airline to help you Chișinău, are placed in the newest airport. The brand new Congressional Funds Place of work, a nonpartisan category accountable for rating the new budget, ideas that bill perform increase federal deficits along side next a decade by almost $step 3.step three trillion.

You don’t need to make in initial deposit for those who don’t desire to – it’s a no cost slot. The new zero install choice is present, meaning that you could potentially choose to play the games on line. And distinguished is that the RTP of the slot servers try 96%, which will help rather to hit specific prominence.

You may also throw Name Lightning once for each change as the a great 100 percent free action. After you come to seventh height, Because the a plus Action, you take momentary power over you to animal you will see within this 30ft which you have Transferred an excellent Quirk, Function or Enchantment in order to. You decide exactly what step the brand new animal will need and you can where they often circulate throughout the its 2nd change. An involuntary creature automatically goes wrong the protecting throw, and you will isn’t incapacitated as you manage their procedures.

Secure Marriott Things to the Emirates Aircraft & Earn Emirates Skywards Miles to the Marriott Stays

- Unlike removing taxation for the Public Shelter benefits, beneath the the fresh plan, certain Western taxpayers more than 65 can get discovered an extra income tax deduction.

- Sometimes enable your allies which have quirks or perform an armed forces from beasts which use numerous quirks.

- It was merely date the facts made it to your reels and you will provided people a method to win big when you’re immersing by themselves on the such a famous tale.

- Depending on the legislation, it could be effective to have income tax years 2025 because of 2028.

- Once you reach 11th height, while the a task, you could experience if you can find any pets that have a quirk otherwise spellcasting element in this step 1 distance people.

The brand new 2017 tax legislation introduced a great $ten,100 cover to your number of county and you can local tax (SALT) money anyone you may deduct from their government taxes. The new laws briefly escalates the tolerance to $40,100000 to own taxpayers with an altered modified revenues less than $five-hundred,one hundred thousand. Enterprises explore formations for example limited-liability organizations (LLCs) or S companies to pass earnings through to the people instead investing income tax at the team level.

The package rather included a short-term income tax deduction to own the elderly 65 and more mature. Here’s what you should find out about the fresh income tax deduction to have qualified older taxpayers. The credit, which was set-to end at the end of 2025, is now permanent. Simultaneously, employers are now able to render it so you can experts immediately after 6 months of employment; in past times, minimal service requirements is a year. All the For starters provides some special symbols which can without difficulty change the video game in your favour.

That it function can only be studied twice for each Brief otherwise Long Others. You could allow yourself Blindsight in the 30ft, wich will make you advantage on Impact and you may Study Checks for the next ten minutes. After you have used that it function you ought to get an initial otherwise Much time Rest for action once more.

You could shed Protect some minutes comparable to your competence incentive for each and every Enough time Others. Your find out the means Wall structure from Push and you may Industry from Invulnerability, you can also cast Gust from Breeze while the a plus step, a lot of minutes comparable to your own proficiency bonus for each and every Much time Others. As the an activity, your deconstruct the brand new surface close to you for as much as 5 times the Charm modifier (minimum of step one) feet. It matters while the difficult surface and all of pets excluding your you to definitely make an effort to undergo they bring 1d6 sharp destroy per 5 ft they flow. Marriott Travel Pub is a timeshare system that provides added bonus things, provide cards, resorts credit, or any other pros when you go to a great timeshare demonstration individually or virtually.